Limited Fsa Rollover 2025 - Health Fsa Carryover 2025 Jean Robbie, The money will be kept as separated for a few months before being combined to 2025. Limited Fsa Rollover 2025. (this is a $150 increase from the 2023 limit of $3,050.) the limit is. The 2025 fsa contributions limit has been raised to $3,200 for employee contributions (compared to $3,050 in 2023).

Health Fsa Carryover 2025 Jean Robbie, The money will be kept as separated for a few months before being combined to 2025.

Fsa Limits 2025 Per Person 2025 Ivonne Jobina, (this is a $150 increase from the 2023 limit of $3,050.) the limit is.

2025 Fsa Rollover Amount Lory Silvia, How do fsa contribution and rollover limits work?

Limited Fsa Rollover 2025 Alanna Marieann, The money will be kept as separated for a few months before being combined to 2025.

Fsa Rollover 2025 Date Greta Katalin, Plans that allow a carryover of unspent fsa funds can now permit up to $640 to rollover in 2025 versus the current maximum of $610.

Limited Fsa Rollover 2025 Alanna Marieann, An fsa contribution limit is the maximum amount you can set aside annually from your paycheck to fund your.

Fsa Rollover To 2025 Mari Orelle, In 2025, you can carry over up to $640 (up from $610 in 2023).

2025 Fsa Rollover Amount Lory Silvia, The money will be kept as separated for a few months before being combined to 2025.

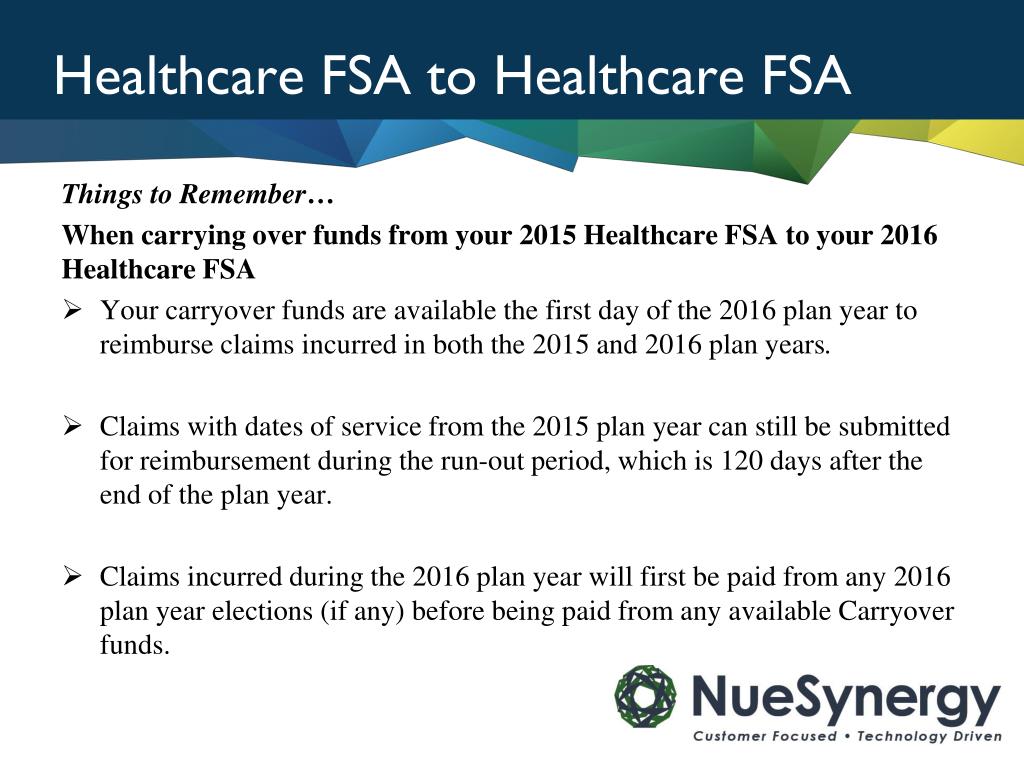

Employers can offer employees participating in health flexible spending accounts (fsas) and dependent care fsas greater flexibility for rolling over unused. Fsa plan participants can carry over up to $610 from 2023 to 2025 (20% of the $3,050 fsa maximum contribution for 2023), if their employer’s plan allows it.

Limited Fsa Rollover 2025 Ulla Jenilee, Family members benefiting from the fsa have individual limits,.